What do I need to know about National Insurance Contributions?

Payroll can be a tricky business, it’s important as an employer to ensure that you know all the rules and applicable rates which you are liable to pay. The government website offers lots of important information but it can be difficult to absorb. Here’s a breakdown of rates of National Insurance you need to be aware of.

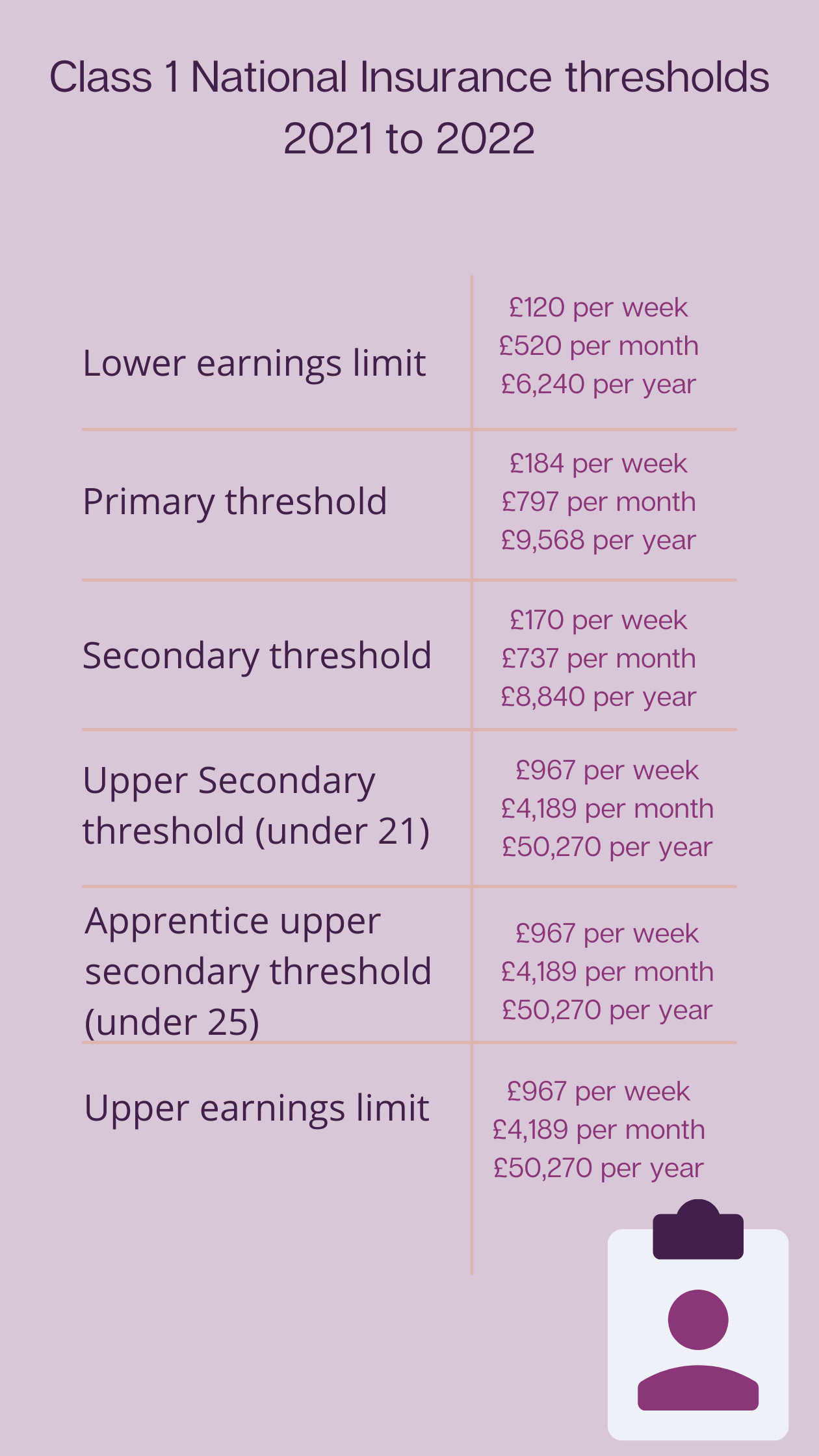

Class 1 National Insurance Thresholds

You only apply National Insurance reductions on earnings which are over the lower earnings limit.

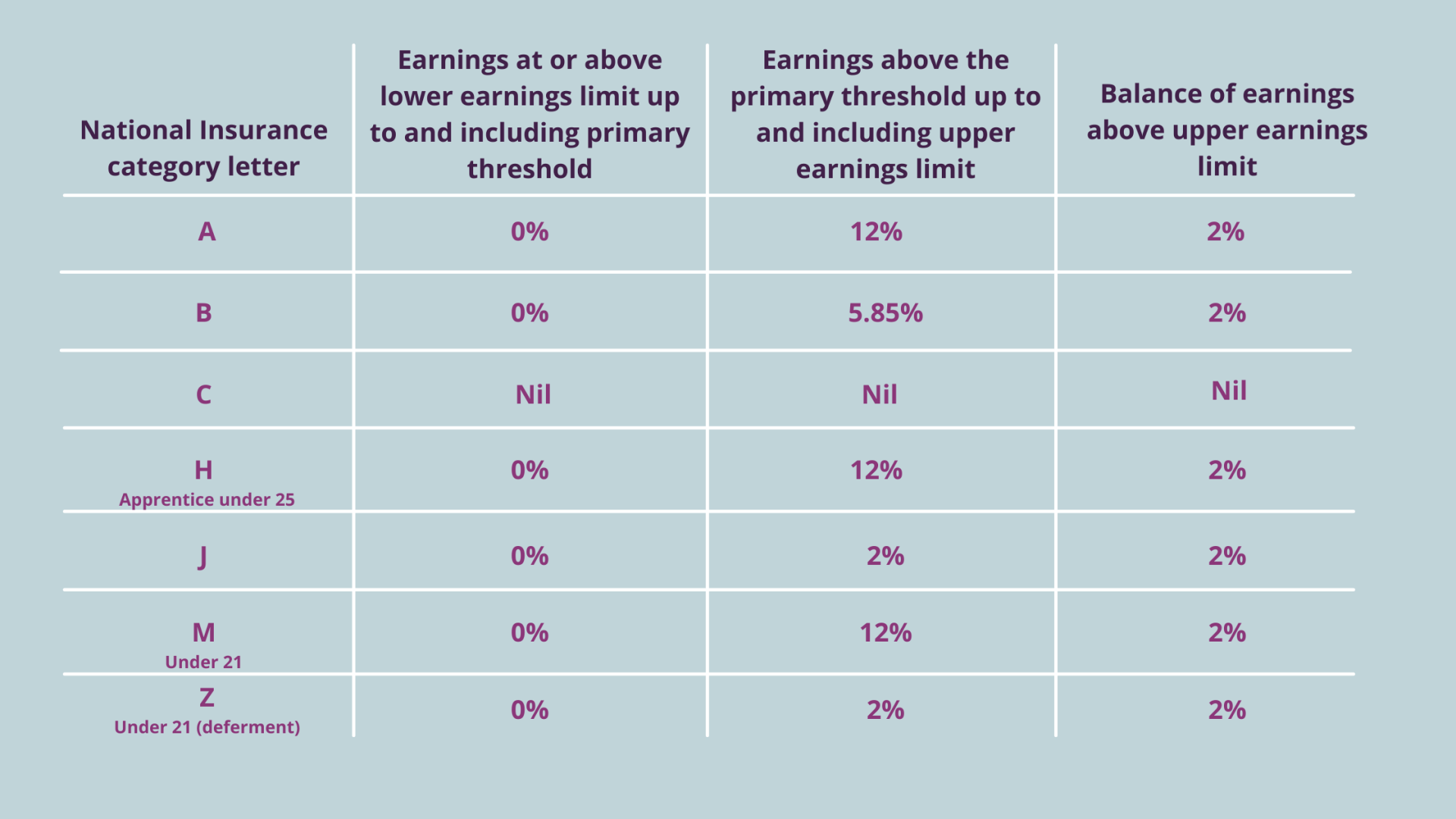

Class 1 National Insurance Rates

Employee (primary) Contribution Rates

Here’s the rates you need to be aware of when deducting your employee’s national insurance contributions from their pay through PAYE:

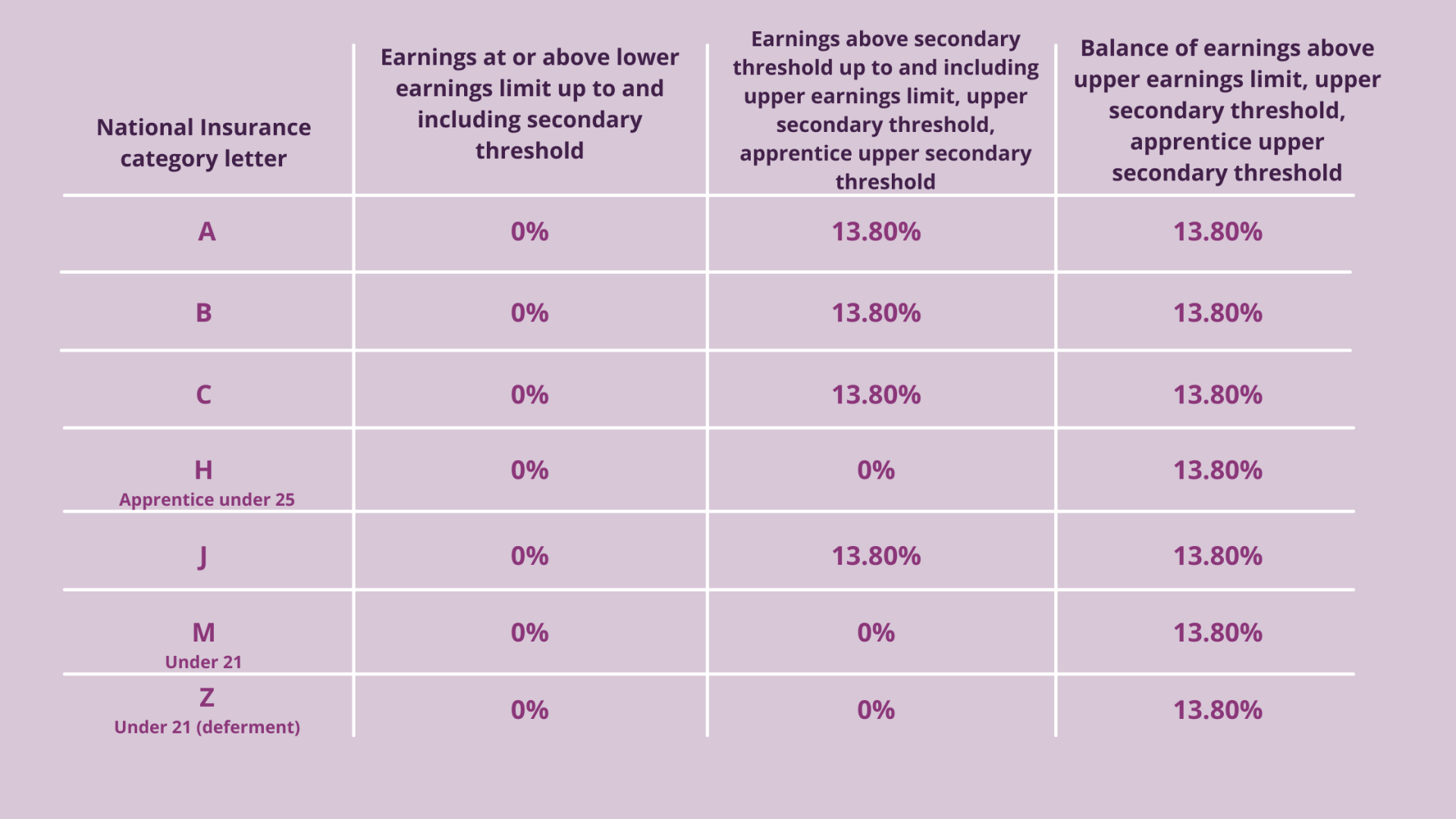

Employer (secondary) Contribution Rates

As part of your PAYE bill you pay secondary contributions also known as employers National Insurance:

Class 1A NI

Employees must pay Class 1A National Insurance on any company benefits they receive such as a company car or mobile phone. You will need to declare these at the end of each tax year.

Any termination payments to employees exceeding £30,000 will be subject to employer tax and national insurance, you can find out more here These types of payments should be declared as part of your payroll each year. The rate of this is 13.8%

Class 1B NI: PAYE Settlement Agreements (PSAs)

If you have a PAYE Settlement Agreement you will be liable to pay Class 1B National Insurance. This means that you make one yearly payment to cover all the tax and NI due. Again the rate for this is 13.8%

National Insurance (Self Employed)

If you are self employed there are 2 classes you can fall into. Class 2 is for profits of £6,515 or more a year and Class 4 if your profits are £9,569 or more a year.

Class 2 will pay £3.05 per week whereas Class 4 is charged at 9% on profits between £9,569 and £50,270. For profits over £50,270 there will be a further 2% deduction.

Some people may be exempt for this if they fall into any of these categories, however it may be advisable to pay voluntary contributions

- Examiners, moderators or exam invigilators

- Religious ministers who do not receive a salary or stipend

- People who make investments for themselves or others but not in a business capacity (with no fee or commission)

If you’re unsure of the amount you have paid towards your National Insurance contributions you can check your National Insurance record online on the Government Gateway website here. You will need a Government Gateway login, if you don’t have one you can sign up for one by following the above link. It can be helpful to check your records if you have any gaps in contributions, this way you will know if it’s advisable for you to pay voluntary contributions towards your State Pension.

The State Pension

You will be eligible to claim your state pension if you’re:

- Male and born on or after 6th April 1951

- Female and born on or after 6th April 1953

If you reached the State Pension age before 6th April 2016 then the old rules will apply

In order to qualify for State Pension you will need at least 10 qualifying years of National Insurance contributions, however these do not have to be consecutive years.

Once you hit the State Pension age you can continue to work if you wish to do so and you will then be exempt from paying National Insurance Contributions.

Most people aren’t aware of the reasons behind having to pay National Insurance so we hope we have clarified a few aspects for you. If you are still unsure of the rates applicable to you then please get in touch, we have a network of experts that can help.

Join the mailing list

Contact Us

We will get back to you as soon as possible.

Please try again later.